Unraveling the Offshore Web: British-Georgian Investors and Their Armenian Partners Target Armenia’s Mines

On October 26, 2012, Armenia’s Haykakan Zhamanak daily newspaper, owned by the family of Prime Minister Nikol Pashinyan, published an English advertisement about the investments a group of British businessmen planned in Armenia's mining sector. The day before, the paper had published the Armenian version of the advertisement. The paper usually does not publish English advertisements. Also of note, is one of the investors named in the ad - Sir Tony Baldry, knighted in 2012 who served as member of the British Parliament from 1983-2015. The British investors clearly made the announcement through their Armenian partners. And who was the "leader" of the latter? That would be Vardan Ayvazyan, who was a Republican Party of Armenia MP at the time, who served as Chairman of the Parliamentary Standing Committee on Economic Affairs (2007-2017) and Minister of Nature (2001-2007).

Hetq has obtained documents revealing the business relationships and business network he has established with British colleagues who set up businesses in Armenia through offshore companies.

Pandora Papers - new outflow from offshore zones

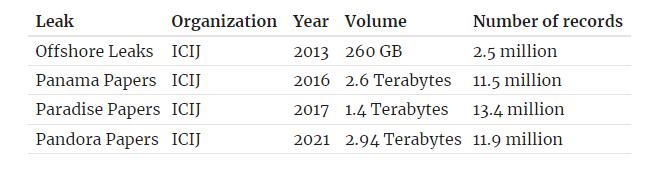

Hetq received these documents from our partners, the International Consortium of Investigative Journalists (ICIJ). These are leaked documents from various offshore zones. The entire portfolio, dubbed the Pandora Papers by reporters, is the largest package ever released by the consortium.

Here is a comparison of Pandora Papers and other previously published folders by ICIJ, including volume bytes and number of documents.

The documents were studied by more than 600 journalists from 117 countries and territories. The Hetq team from Armenia is participating in the project. The companies in Pandora Papers (more than 27,000) and their owners (around 30,000) are connected to more than 200 countries and territories around the world, which speaks to the very large geographical scale of the leaked documents. The 2.94 terabyte folder also contains the names of Armenians who are the ultimate beneficial owners (UBOs) of companies, including officials and businessmen, and their affiliates.

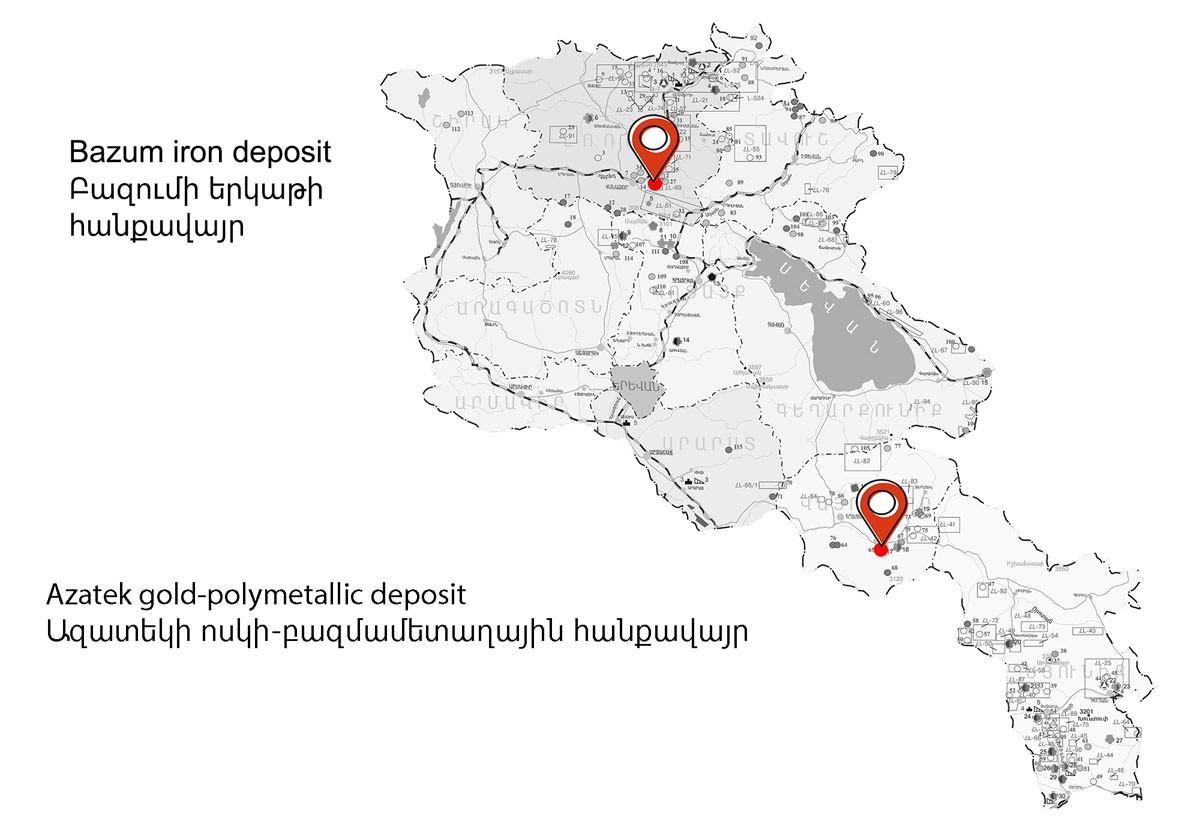

British investments are coming to Armenia

In October 2012, British investors announced in a statement published in Haykakan Zhamanak that they were going to launch two projects in early 2013: the Bazum iron mine in Armenia’s Province Lori region and the Azatek gold-polymetallic mine in Vayots Dzor. According to the announcement, up to US$400 million was to be invested in the implementation of the projects and 5,000 jobs would be created. “It will be of significant importance for Armenian national economy due to the resulting appearance of related infrastructure like power grid, railways, chemical–plants etc. Significant financial contribution is committed to this project by Saudi Investment fund Al-Dhowayan Group which is also partner in the project,” the statement reads.

The British investments were to enter Armenia through the local companies VaykGold Ltd. and Surart Ltd., the first of which, according to a report published in Haykakan Zhamanak, had already applied to Armenia’s Ministry of Energy and Natural Resources with industrial and environmental proposals for the Azatek mine. Surart had a license to explore the Bazum mine. According to the announcement, the mine management companies would be Coeur Gold Armenia Ltd and Bazum Steel Ltd, which were the parent companies of VaykGold and Surart.

However, in October 2012, according to Armenia’s State Register, the Armenian companies were still wholly owned by Vardan Ayvazyan and his entourage. On the other hand, the noted managers were offshore companies (although there was no mention of that) - Coeur Gold Armenia in the Seychelles and Bazum Steel in Belize.

The ad also refers to local partners of British investors but does not name names. In this case, we can surmise that we are talking about the owners of VaykGold and Surart, in particular, Vardan Ayvazyan.

The ad reads:

Armenian subsidiaries make part of the holding as «overseas-local partnerships, very much collaborating with local geology and mineral expertise», as described by Sir Tony Baldry, British Conservative MP and a board member of Coeur Gold Armenia Ltd. and Bazum Steel Ltd. «We will be looking with British finance to bring these projects to reality», he said, «hopefully we will be able to start sited works early next year, which is just a subject of obtaining all the required permits».

According to the paid advert, the British planned to invest not only in mining, but also in other projects, which in the future were to be integrated into the industrial cluster. Here’s another excerpt from what was published in Haykakan Zhamanak.

«At this stage it's early to disclose what other industrial projects are under a detailed study, but our approach is not just picking one or two most profitable projects. We are here for the long term, that's why we are determined to spend that much time and effort, as we get more comfortable with our starting investments. In that sense further extension would be quite natural», added Nathan Lawry, Director of Strategy of the projects. As part of that vision, the company has recently met with the management of Russian-owned Vanadzor Chemical Plant CJSC in the north of the country. «We've had a quite positive dialogue on how we can cooperate in the future».

Why wasn’t the Surart project implemented?

Surart Ltd. was founded in November 2005. The only owner and director was then Minister of Nature Protection V. Ayvazyan's eldest son, Suren Ayvazyan (the name of the company is derived from his name). In January 2007, he transferred his entire stake to Suren Badalyan from Yerevan, who in turn transferred the company back to Suren Ayvazyan in July 2008. In January 2011, he handed over the company to his father, then an MP from the ruling Republican Party. The Ayvazyans are registered in Charentsavan but live in Yerevan’s Vahakni district. Until 2007, Surart was registered in Yerevan at the residence of Tigran Krmoyan, the assistant of the Minister of Nature Protection Vardan Ayvazyan, and then moved to Charentsavan (but not to the Ayvazyans).

Vardan Ayvazyan

In May 2011, two companies registered at the same address in Belmopan, the capital of Belize, became shareholders in MP Ayvazyan's company. 60% of Surart passed to Bazum Steel Ltd, 21% to Bazum Mining Operations, and 19% remained with Vardan Ayvazyan. However, the offshore companies did not stay here long and left Surart in October 2011, leaving 100% of it to Ayvazyan again. We were not able to find out exactly who the real owners of the Belize companies were at the time, but their brief stake in Surart in 2011 did not end there.

It should be noted that at that time Surart had a license to explore the Bazum mine, which it received in February 2008 and was valid until December 2012. That is, as of October 2012, when the British were announcing their upcoming investments, Surart had rights to the Bazum mine.

In March 2013, according to Armenia’s State Register, Bazum Steel Ltd. acquired Surart LLC from Vardan Ayvazyan and is still its sole owner, but the director since Ayvazyan’s time, since 2008, is Ashot Hovhannisyan from Yerevan. To our question whether Ayvazyan is currently connected with Surart, Hovhannisyan answered. "Maybe he used to have a connection, but not now."

The ICIJ has asked questions of former British MP Tony Baldry, who, according to the investor advertisement, was a board member of Coeur Gold Armenia Ltd. and Bazum Steel Ltd.

Tony Baldry

The British politician mentioned that, as far as he could recall he was a member of the board of Bazum Steel Ltd. in 2012-2014, after which he no longer had any contact with the company. At the same time, according to him, he was not the owner. According to Baldry, he visited Armenia once, around 2012, and visited the Bazum mine. He noted that the geological documents mentioned significant reserves in the mine, and the advantage was that there was a railway (Yerevan-Gyumri-Vanadzor-Tbilisi) in the neighborhood. However, according to Baldry, the project was still in its infancy, and although he knew he had all the necessary documentation to do the extraction (in fact, the company did not receive an operating license), the project did not materialize as world iron prices collapsed. It was impossible to attract the necessary investment from the London Stock Exchange for a project that required significant infrastructure (the way to get money from the stock exchange was to list the shares there, but it did not work out).

Surart's director Ashot Hovhannisyan told Hetq that there were reserves at the Bazum mine, but iron prices were so low that if Armenia got ore concentrate and then exported to Europe via Georgia and the Black Sea, the cost would be high, and the program would not justify itself.

Regarding the announcement published in Haykakan Zhamanak, Tony Baldry told ICIJ that he was not aware of it․ As to the $400 million investment and the creation of 5,000 jobs, he said:

"This was a project in its very earliest stages and I would be very doubtful that at that point anyone could have sensibly projected the likely number of people to be employed on such a project, or its eventual value."

Thus, years after making a flashy announcement about the investments to be made in Armenia, one of the former investors clearly said that it was unreasonable to announce such figures. When we sent him the photo of the advertisement printed in Haykakan Zhamanak which also contained his own words, the Briton, by and large, repeated the same thoughts he had said before, sidestepping the big promises made about the investment, jobs and creating an industrial cluster.

In the advert, however, the same Baldry spoke about the role of the Armenian partners and had this to say about Vardan Ayvazyan.

"So far as I can recall, I have never met Vardan Ayvazyan. I don't recognise the name."

This is strange, not only because Surart belonged to Ayvazyan at that time, but also because during that time British MP Baldry came to Armenia and visited the Bazum mine without the knowledge of the British Embassy in our country. This probably means the visit took place with the support of his Armenian colleagues, mainly Ayvazyan.

The British Embassy in Armenia told Hetq that they were not aware of the details of the British investors' mining plans in Azatek and Bazum and the possible visit of then-MP Baldry. The Surart director, in a conversation with Hetq, never mentioned Baldry’s name, saying that he did not know such a person.

According to Armenia’s State Revenue Committee, Surart Ltd. has suspended operations. As for the Bazum iron ore mine, no company has the right to study or exploit it now.

It turns out that the Ayvazyans' interest in this mine has not diminished. Founded in Yerevan in September 2016, Iron Mining Ltd. applied to the Ministry of Energy Infrastructure and Natural Resources in December of the same year to conduct a study at the Bazum mine. In March 2017, the company received such a permit for three years. Iron Mining was founded by the Ayvazyans' relatives, and since March 2018 the only shareholder is Suren Ayvazyan, who has replaced Artashes Kakoyan from Yerevan.

VaykGold’s shadowy history

VaykGold Ltd. was founded in June 2012 by Vardan Ayvazyan (20%), who was then an MP, and Ashot Hovhannisyan (80%), also a director of the company. Hovhannisyan, who is still the director of Surart, was once the director of Fortune Resources Ltd., which is linked to Ayvazyan. VaykGold was registered at Hovhannisyan's registration address.

In November 2012, director Hovhannisyan signed a contract with the then Minister of Energy and Natural Resources Armen Movsisyan to develop the Azatek gold-polymetallic mine in Vayots Dzor. This permit was given to VaykGold for 25 years, until 2037.

According to official data, the total volume of ore reserves at the Azatek mine is 6,818,000 tons, with an annual production volume of 300,000 tons. The content of metals in 6.8 million tons of ore was estimated as follows: Gold - 17,481 kg (17 tons), silver - 397 tons, copper - 5,000 tons, copper - 13,200 tons, zinc - 18,800 tons, lead - 37,200 tons.

Six years after the signing of the agreement, in November 2018, when a new government was functioning in Armenia, the Prosecutor General's Office (PGO) announced that a criminal case had been filed for violating the rules of subsoil protection and use and abuse of official authority.

According to the PGO, officials of the Ministry of Energy and Natural Resources, using their official position against the interests of the service and ignoring the requirements of the law, signed a mining license agreement with the CJSC in April 2009. Although the PGO does not name names, we’re talking about the issuing of a license to the Armenian Azatekgold CJSC to operate the Azatek mine, and the then minister (2008-2014) was Armen Movsisyan. The PGO stated that in March 2011 the right to operate the CJSC was terminated due to violation of contractual obligations and legal requirements, after which the ministry officials abused their position. In November 2012, the permit to operate the mine was given to another company. The PGO refers to VaykGold.

In fact, according to the PGO, Azatekgold received a license in 2009 in violation of the law. The same happened in 2012 in the case of VaykGold. It should be noted that after being deprived of its license in 2011, Azatekgold sued the ministry headed by Armen Movsisyan, demanding to invalidate the relevant order of the minister. The administrative court upheld the claim, but the ministry appealed to the Appeals Court, which overturned the lower court's decision, and the Cassation Court returned the mining company’s appeal twice, upholding the appellant's decision in favor of the ministry. The trial ended in October 2012, and in November the right to exploit Azatek was transferred to Vardan Ayvazyan's company.

According to the PGO, giving a license to VaykGold illegally is not the only episode related to the latter. Another one related to mineral extraction took place in 2017, but we will return to that later.

In January 2013, V. Ayvazyan gave his 20% to his brother's daughter-in-law, Zhanna Muradyan from Yerevan, and in February, Hovhannisyan and Muradyan's shares equalized, becoming 50% each.

As announced by the British investors in October 2012, VaykGold’s parent company was Coeur Gold Armenia Ltd, but according to Armenia’s State Register, the latter became the owner only on July 22, 2014, acquiring 80% of the Armenian company and 20% remained in the name of Zhanna Muradyan.

The offshore company acquired two mines on the same day

On July 22, 2014, Coeur Gold Armenia not only acquired VaykGold, but also 80% of Vardan's Zartonk Ltd. The latter was founded in 2001, and in August 2012 it received a license for 14 years (until 2026) for the exploitation of the Sofi-Bina gold-polymetallic mine in Vayots Dzor. According to official data, the total volume of ore reserves is 139,600 tons, and the annual production volume is 10,000 tons. The content of metals in the ore was estimated as: gold - 641.5 kg, silver - 51 tons, lead - 1047 tons, zinc - 1506 tons.

Before the company registered in the Seychelles dealt with Vardan's Zartonk Ltd., its shareholders were Vardan Ayvazyan's son Suren Ayvazyan (40%), Yerevan residents Hrachya Hovhannisyan (40%) and the above-mentioned Artashes Kakoyan (20%). When Coeur Gold Armenia gained 80%, Ayvazyan and Hovhannisyan were left with 8% each, and Kakoyan with 4%.

Going forward, let us mention that in April 2018, Coeur Gold Armenia left this company. Ayvazyan, Hovhannisyan and Kakoyan have restored their 40-40-20 ratio of shares. And later, in November 2020, Hrachya Hovhannisyan became the sole shareholder of the company. He is also the director. The company is registered at 6 Yekmalyan Street, Yerevan, where Iron Mining Ltd., which studied the Bazum mine from 2017-2020, also operates. In addition to the address, these companies are united by individuals - Suren Ayvazyan and Artashes Kakoyan, who have been shareholders in them at different times. Kakoyan is the head of the Ayvazyans' legal team (Investment Low Group LLC, registered at Yekmalyan 6). The members of the team are Sayad Badalyan and Sevak Aleksanyan, who were once involved in Iron Mining and Vardan Zartonk.

Coeur Gold Armenia: Who was hiding behind the offshore company?

This company was established in September 2011 in Victoria, the capital of the Seychelles, by British citizen George Howard Richmond. The latter is 52 years old, was born in Tbilisi and is of Georgian origin - Georgi Mgaloblishvili. Moreover, the Richmond-Mgaloblishvili connection to the Azatek mine began earlier than the establishment of Coeur Gold Armenia and VaykGold.

A self-proclaimed businessman

As mentioned, the right to exploit the Azatek mine was given to Azatekgold CJSC in 2009. The latter was founded in May 2008 by the Armenian Armeniaak Ltd. (99%) and the Russian Alrosa OJSC (1%). The shareholders later changed.

A statement issued in August 2010 said that Ireland’s Anglo-African Minerals plc (AAM) had acquired the Canada-based Belgrave Mining Corp., which was owned by Singapore-based Caspian Resources Development Pte Ltd. Belgrave Mining owned 74% of Azatekgold CJSC. The statement said that the previous owner, Caspian Resources Development Pte Ltd, was affiliated with the well-known Russian company Sistema, which was wrong, because it was not the Russian company, but George Richmond’s Sistema Group. Moreover, the same Sistema Group was to build a processing plant, valued at $40 million, based on a contract with AAM to operate the Azatek mine and supply process equipment. It turns out that Richmond had a connection with Azatek prior to the 2010 deal and afterwards.

As we can see in the investor presentation about AAM, which took place in July 2010, George Richmond introduced himself as the AAM’s operations director for Armenia, as well as a Georgian metallurgist and a representative of the Russian Sistema corporation in Britain. It was mentioned in the presentation that AAM, which owned 74% of Azatekgold, had the right to acquire the remaining 26% of the Armenian company, which belonged to the Russian Alrosa OJSC.

George Richmond

In fact, Richmond's Sistema Group had nothing to do with the Russian Sistema Corporation, nor was he its representative. And although the Georgian businessman has been speaking on behalf of a well-known Russian company since at least 2010, Sistema covered the issue only a year later, in November 2011.

"We have learned that Mr. George Richmond (also known as Georgi Mgaloblishvili) may have been involved in negotiations with third parties as an authorized representative of AFK Sistema and its affiliates," Sistema said, noting that Richmond is not an employee of it or affiliated companies and has not received any instructions from the management of Sistema to negotiate or correspond with the latter's employees or third parties.

"Currently, we are taking a number of measures to stop Mr. Richmond from introducing himself as a representative of AFK Sistema," the Russian side said. The Russian newspaper Vedomosti also learned from its source in Sistema that Richmond had indeed negotiated on behalf of a Russian company and even set up a company (Sistema Group), in which he referred to Sistema. However, the Russian corporation was not harmed, and its representative Yulia Belous stated that the Russian side has nothing to do with the Azatek mine deal.

Thus, Richmond was connected to Azatekgold and Azatek gold-polymetallic mine through Caspian Resources Development Pte. Ltd. and then Anglo-African Minerals. Richmond appeared on the scene when a permit to exploit the mine was given to Vardan Ayvazyan's VaykGold in 2012.

Coeur Gold Armenia’s changing owners

ICIJ sent questions to both Richmond and Ayvazyan. They did not respond to emails, phone calls or messages. However, since Richmond was born in Tbilisi and Ayvazyan is from the village of Tabatskuri in the Borjomi region of Georgia, it’s possible their connection is via through Georgia/Georgian circles.

As we said, in July 2014, Richmond’s offshore Coeur Gold Armenia became the owner of 80% of VaykGold, and the remaining 20% was owned by Ayvazyan's brother's daughter, Zhanna Muradyan.

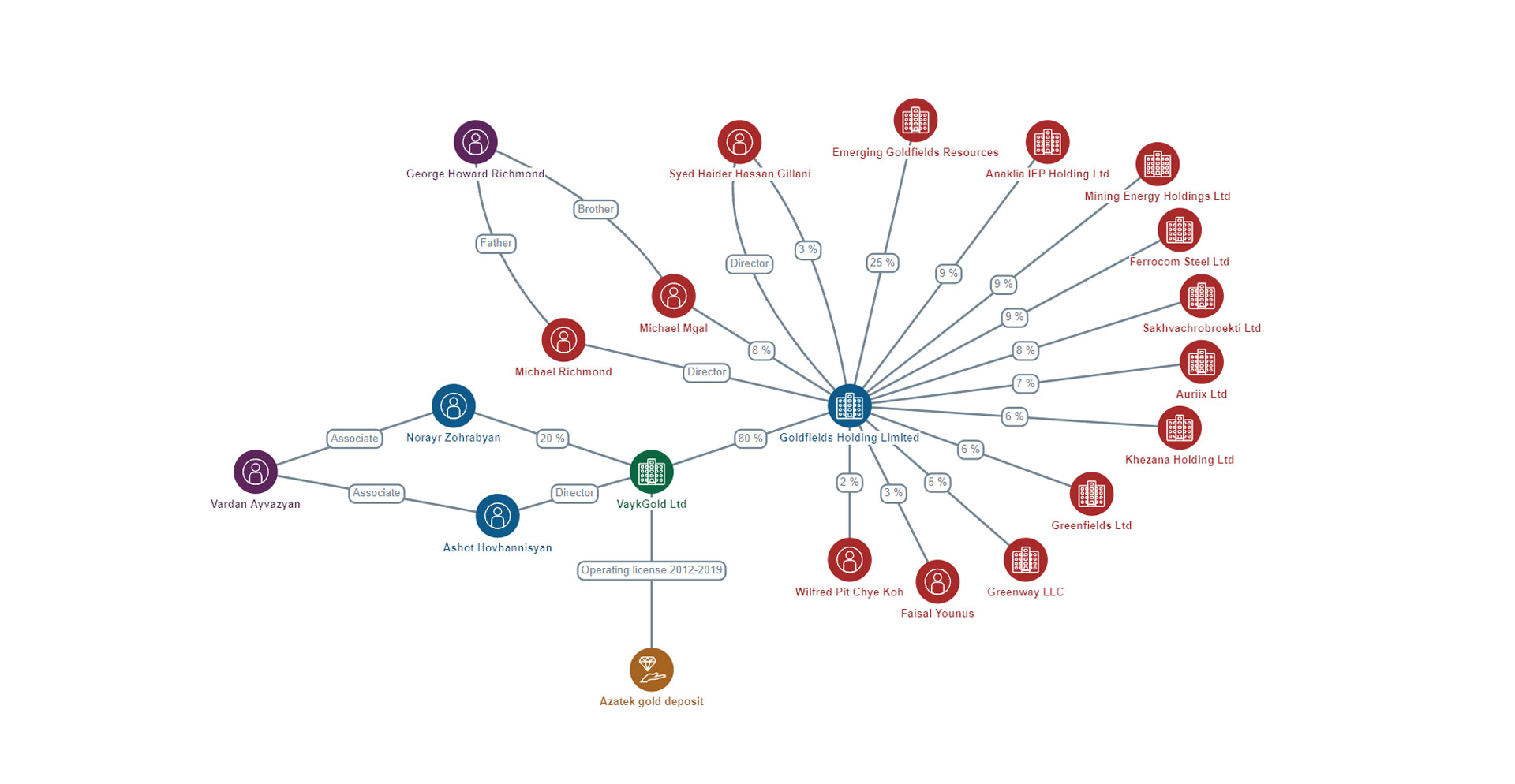

The documents in Pandora Papers show who were the final beneficiaries of Coeur Gold Armenia and, consequently, VaykGold’s controlling stake over time.

In its founding documents in 2011, it was mentioned that the sphere of activity was mining, metallurgy, geological exploration, management, and the regions of activity are Kyrgyzstan, Armenia and Russia. The only owner and director was G. Richmond, registered in London.

Thus, in the fall of 2012, when British investors announced their involvement in VaykGold and the Azatek mine through Coeur Gold Armenia, the only owner and director of the offshore company was George Richmond. Against this backdrop, it is interesting that British MP Sir Tony Baldry was presented in the advert published in Haykakan Zhamanak as a member of the board of directors of Coeur Gold Armenia and Bazum Steel companies. He told Hetq that he was not aware of Coeur Gold Armenia and was not its director or owner and had no idea about the Azatek mine.

In 2014, Richmond transferred his entire stake in Coeur Gold Armenia to the offshore GR Business Holdings Ltd. (based in Road Town, the capital of the British Virgin Islands, a company he owned. (GR stands for George Richmond). The director of Coeur Gold Armenia has not changed, he has remained the director. In July 2016, there was a new change. 99.999% was owned by Singaporean Ace Minerals Private Limited (founded a month prior, in June, Singapore is also an offshore zone), and 0.001% - G. Richmond, who also remained director. The Singaporean company was headed by Sim Chek Tong, but it operated in the interests of George Richmond, who was the ultimate owner of both Ace Minerals Private Limited and Coeur Gold Armenia.

In April 2018, Michael Mgal, a 49-year-old British citizen from London, born in Tbilisi, became the registered owner of the entire share of Coeur Gold Armenia. Readers may have guessed that he is a relative of George Richmond or Georgi Mgaloblishvili (perhaps his younger brother), and that the surname Mgal is a shortened version of the Georgian, and that Michael is the same Mikhail. But in this case, too, Richmond-Mgaloblishvili remained the beneficial owner.

Nevertheless, in October 2018, George Richmond sold Coeur Gold Armenia to Argonaut Minerals Limited, a British company owned by Arab and Pakistani beneficiaries. Since Coeur Gold Armenia owned 80% of VaykGold from July 2014 to December 2018, that is, during the new owners, we will briefly introduce the latter.

According to leaked offshore documents, the owner of Argonaut Minerals Limited is Grange Investment Holdings Limited registered on the British Guernsey Island (offshore zone), which is owned by The Carnan Trust operating on the same island. Trust is a form of legal relationship in which the owner of the property hands it over to the trustee, who undertakes to do things with the property that will benefit the beneficiaries to the maximum. In this case, The Carnan Trust is managed by Hansard Trust Company Limited (Guernsey), which operates for the benefit of the families Choudry of Pakistan and the Arab Sheikh families.

Assad Amin Sheikh from the Sheikh family has three companies in Armenia. Of these, Equivest Alliance Foundation LLC and Horizon Iron & Steel Company LLC are in the mining industry, and Grange Power LLC is in the energy sector.

Coeur Gold Holding’s old-new owners

In November 2017, when the beneficiary owner of Coeur Gold Armenia was still G. Richmond, Zhanna Muradyan (the daughter-in-law of V. Ayvazyan's brother), who owned 20% of VaykGold, handed over her shares to Ayvazyan's eldest son Suren Ayvazyan. The latter transferred them to Charentsavan resident Norayr Zohrabyan only two months later (again, the Ayvazyans are also from Charentsavan). It is assumed that Zohrabyan, like Muradyan, is Vardan Ayvazyan's representative in VaykGold. But when Hetq asked company director Ashot Hovhannisyan who the real owner of 20% is now, Ayvazyan or Zohrabyan, he said, "Vardan Ayvazyan handed it over a long time ago, it is Norayr Zohrabyan."

If Zohrabyan still owns at least 20% of VaykGold on paper, his partners have changed several times. As we have seen, in October 2018, Richmond handed over Coeur Gold Armenia to the Pakistanis and Arabs, but the latter stayed at VaykGold for a short time until December. It is not ruled out that one of the reasons for the exit was the message spread by the Armenian Prosecutor General's Office in November about obtaining a license and illegalities during the extraction of minerals, resulting in a criminal case being launched. The fact is that in December 2018, Seychelles Coeur Gold Armenia sold its 80% stake to the British Coeur Gold Holding Ltd. It is not difficult to understand who was behind the latter - George Richmond, the same Georgi Mgaloblishvili. One gets the impression that the connection of the Georgian businessman with the Azatek mine is endless.

Coeur Gold Holding Ltd. was founded in June 2018, in London, by Richmond's alleged relative, Michael Mgal (Mikhail Mgaloblishvili), who was also the director. In the fall of the same year (before the British company acquired 80% of VaykGold), new owners joined. But in July 2019, 80% of Coeur Gold Holding in the Armenian company was registered in the name of another British company, Goldfields Holding Limited.

Going forward, we should note that in November 2020 Coeur Gold Holding sued Goldfields Holding Limited, VaykGold and the State Register of Legal Entities of the Ministry of Justice of the Republic of Armenia. The plaintiff demanded to invalidate the purchase agreement signed between it and Goldfields Holding Limited on June 19, 2019, as the transaction took place outside the limits of its authority. The trial of the case is in progress.

Who really owns 80% of VaykGold?

Goldfields Holding Limited became the owner of VaykGold just two months after its creation (May 2019), which probably means that this London company was founded for that very purpose. According to the British Register, the first sole owner was Jinyuan Wang. The directors were Wang, George Richmond and Ahti Vilppula, a Finn. The owners of this company have changed regularly since its foundation. As of September 28, 2021, the 100 shares of Goldfields Holding Limited are distributed as follows:

In fact, the largest owner (25%) of Goldfields Holding Limited is Emerging Goldfields Resources Ltd., founded in May 2020 in Calgary, Canada. But it is noteworthy that this company has not had an owner since its inception. This is possible under Canadian law. The minimum requirement is the presence of one director. Emerging Goldfields Resources Ltd has four directors, whose names, however, will not mean anything to the reader. However, it seems likely that this company was founded on the initiative of George Richmond. The fact is that the Canadian company appeared in Goldfields Holding Limited in September 2020, when one of the former owners of the British company, Sim Chek Tong from Singapore, transferred his 25% stake to it. Sim is a Singaporean whose Ace Minerals Private Limited was the formal owner of George Richmond’s Coeur Gold Armenia. In other words, he acts for Richmond's interests.

Against this backdrop, it becomes clear why only 20% shareholder Norayr Zohrabyan and director Ashot Hovhannisyan are represented in the declaration of real beneficiaries of VaykGold. The reason is that the share of only one of the participants of Goldfields Holding Limited, which owns 80% of VaykGold, exceeds 10%, which is the threshold to be considered a real beneficiary under Armenian legislation. And that participant, the Canadian Emerging Goldfields Resources Ltd., in turn, at least according to the documents, has no owner.

When Hetq asked A. Hovhannisyan why the declaration did not show the real owners of 80%, he was surprised at first, then said that they were foreigners. To the question whether he was talking about Goldfields Holding Limited, Hovhannisyan said yes, then added that he does not know the details. He said the company's lawyers deal with such matters and submit declarations to the state. When asked to clarify whether George Richmond is still in VaykGold, Hovhannisyan said, "Well, he there was before. Now, I cannot say." According to the director, he had no contact with the owners, which is a bit odd, and when we asked him to provide the contacts of the Armenian owner, Norayr Zohrabyan, he said, "I’m not affiliated with him.”

Ashot Hovhannisyan and Vardan Ayvazyan have faced charges for some time

As mentioned above, Armenia’s Prosecutor General's Office included in the criminal case initiated in the fall of 2018 not only the episode of obtaining a VaykGold license in 2012, but also a case of mineral extraction in 2017. The Prosecutor's Office was guided by the inspection carried out by Armenia’s Nature Protection and Subsoil Inspection Body at VaykGold before the initiation of the case, during which violations were found. Artur Grigoryan, who then headed the inspection body, banned the company from extracting anything. It turned out that the company in December 2017, mined 1,330 tons of ore at the Azatek mine. The amount of metals was 11.31 kg of gold (worth about 218 million drams), 84.5 kg of silver (about 19 million drams) and 5.25 tons of copper (about 15 million drams). But the extracted ore was not reflected in the reports submitted by the company to the authorized body. According to the PGO, significant damage was caused to the subsoil and the minerals contained in it. Hetq asked the PGO to specify the damage and whether it was compensated for. The PGO said that measures were being taken to determine the extent of the damage.

Armenia’s Investigative Committee charged Ashot Hovhannisyan, director of VaykGold and Vardan Ayvazyan (accused of complicity with Hovhannisyan) with malicious evasion of taxes, duties or other mandatory payments. The charges were later dropped.

"Considering that the combination of factual data obtained during the preliminary investigation and judicial actions during it refuted the circumstances of the crimes committed by the accused Ashot Hovhannisyan and Vardan Ayvazyan under the above-mentioned articles of the Criminal Code, on March 18, 2021, a decision was made to terminate the criminal prosecution against them for committing the crimes envisaged by the mentioned articles of the Criminal Code, on the grounds of lack of guilt in the act. However, within the framework of the criminal case, the preliminary investigation is underway into episodes of other criminal acts,” the PGO said.

In December 2017, when 1,330 tons of ore was mined, VaykGold was owned by Suren Ayvazyan (20%) and George Richmond’s Seychelles' Coeur Gold Armenia (80%). Ashot Hovhannisyan told Hetq that they had submitted the extraction reports to the state.

"We took the ore to Hrazdan as a test sample to determine the technology for obtaining the concentrate. It was the wish of the shareholders of 80% to decide on the technology for extraction," Hovhannisyan said. However, he did not remember which company underwent the experimental processing. Then, according to the director, the ore was sold to Assat Ltd., which operates the Masis gold processing plant. "Assat could not extract because it had no reagents. But we have submitted various reports to the government."

According to reports on the Extractive Industries Transparency Initiative (EITI) website, VaykGold, which has been licensed to operate Azatek since 2012, produced 26.7 tons of precious metal concentrate in 2017, and 5.5 tons in 2018. In both cases, the company sold the concentrate to Assat LLC for 6,675,000 and 687,500 drams, respectively. But A. Hovhannisyan told Hetq that they did not sell concentrate, but ore, to Assat.

Armenia’s PGO told Hetq that in addition to the issues of obtaining a license and mining, the criminal case also included falsifying the agreement on making changes in the additional agreements signed between the former owners of Coeur Gold Armenia and VaykGold. The PGO did not provide details.

Deprived of a license, VaykGold again wants a permit for Azatek

In December 2019, when VaykGold was owned by Charentsavan resident Norayr Zohrabyan (20%) and British Goldfields Holding Limited (80%), the company's right to operate the Azatek mine was terminated by Minister of Territorial Administration and Infrastructure Suren Papikyan. In response, VaykGold Director Ashot Hovhannisyan applied to Armenia’s Administrative Court in February 2020, requesting that the minister's order be invalidated. The trial is ongoing.

Hovhannisyan told Hetq that VaykGold has not been operating since 2015 (not counting the experimental extraction of ore). "We have not been operating since 2015. The company is at a standstill. We are in court.” (The company has also filed an administrative lawsuit against Armenia’s State Revenue Committee this year.)

When VaykGold’s Azatek's license was revoked in December 2019, Vayk-Invest Ltd. was founded in January 2020 and wanted to operate Azatek. The current director of Vayk-Invest is geologist Vahe Malkhasyan, who previously worked at VaykGold. The owner is GM Mining Ltd., registered in Hrazdan, which in turn belongs to Hamlet Simonyan from Yerevan.

However, VaykGold never gave up, and although it tried to invalidate the license revocation order in court, it launched a “Plan B”. In July of this year, the company applied for a preliminary environmental impact assessment of the Azatek operation to Armenia’s Ministry of Environment. In this regard, director A. Hovhannisyan said. "In any case, the foreigners (meaning the owners of 80% - ed.) have invested so much that they want to address that issue."

In August 2020, Vardan's Zartonk’s permit to operate the Sofi-Bina gold-polymetallic mine was revoked by former Minister S. Papikyan. This company is also linked to the Ayvazyans. The company also challenged the minister's order in court. Company lawyer Karo Mikayelyan petitioned the Administrative Court to suspend the execution of the order until the end of the court case. The court rejected the motion. However, the Administrative Court of Appeals upheld the company's request, and Papikyan’s order was suspended for the time being. Later, the Ministry of Territorial Administration and Infrastructure filed an appeal to the Cassation Court, but the court never examined it. The ministry didn’t file the complaint on time.

Interestingly, Cassation Court Judge Stepan Mikayelyan did not take part in the decision and withdrew, stating that he was the father of the company's lawyer Karo Mikayelyan, and this could cast suspicions as to his impartiality. Karo Mikaelyan also represents the interests of VaykGold against the Ministry of Territorial Administration. In this case, when the ICIJ sent him the questions intended for Vardan Ayvazyan to pass to the former official, Mikayelyan answered, "The person who’s name is Vardan Ayvazyan has never been my client."

Hetq will soon report on other foreign companies affiliated with Vardan Ayvazyan, about which we have found documents in the Pandora Papers, as well as the business interests of George Richmond and Assad Amin Sheikh in Armenia. These interests are not limited to the above-mentioned companies.

Azatek mine photos by Saro Baghdasaryan; illustrations by Samson Martirosyan

Videos

Videos Photos

Photos

Comments (3)

Write a comment