Kapan Gold Mine Sold to an Offshore Company for 55 Million USD

Yesterday, Russian Polymetal International plc, registered in offshore Jersey, has signed an agreement with Chaarat Gold Holdings Limited to sell Kapan Mining and Processing Enterprise CJSC. The sale price is 55 million dollars. Vahram Avagyan, Public Relations and Social Policy Deputy Director General of Kapan Mine, responded to our query, providing this information.

As to why the Russian side has decided to sell the Armenian enterprise, Vahram Avagyan replied: "The sale of Polymetal will allow focusing on large-scale projects, from the point of top management’s attention and the perspective of having additional internal financial resources that will be channeled to their construction and development." Let's remind that Polymetal purchased Kapan mine in 2016 from Canadian Dundee Precious Metals.

Chaarat Gold Holdings Limited is registered in the British Virgin Islands. Artem Volynets, CEO of the company, said: "This purchase is a great addition to the Chaarat portfolio and will boost our strategic goal to build a leading gold mining company."

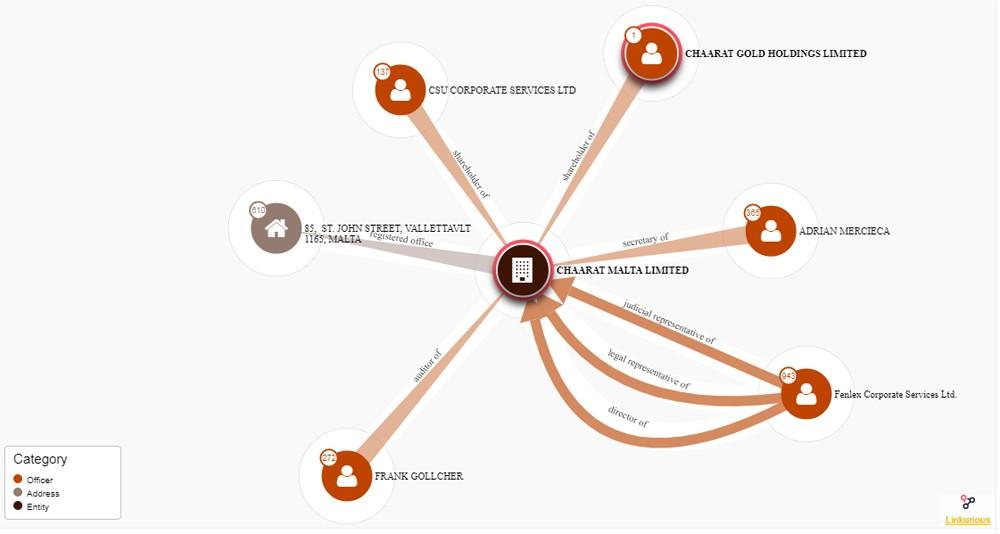

The name of the offshore company can be found in one of the Paradise Papers of the Investigative Journalists International Consortium (ICIJ), featuring some of the structural details of the Chaarat. According to the Paradise Papers, Chaarat Gold Holdings (CGH) is also a co-owner of Chaarat Malta Limited registered in Malta.

On its official website, CGH reports only about its assets in Kyrgyzstan. Here, CGH has established a subsidiary, ChaaratZaav. The Kyrgyz Service of Russian Sputnik informed in April this year that CGH's major asset is the Chaarat district of Jalal-Abad Region of Kyrgyzstan, for which CGH took a loan of $15 million last year. Sputnik says ChaaratZaav got three licenses, two of which were for exploitation, one for exploration. In 2012, the Prime Minister of Kyrgyzstan demanded to close ChaaratZaav due to violation, but later the company got away with paying a fine of 153,000 soms (around $ 2,200).

The executive chairman of Chaarat Gold Holdings is Martin Andersson, who, according to the official website of the company, is CGH's largest shareholder (35.51%).

Videos

Videos Photos

Photos

Write a comment